CVaR Portfolio Optimization

This example shows a Conditional Value at Risk (CVaR) portfolio optimization workflow, which includes:

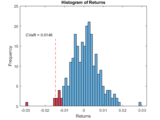

* How to simulate asset scenarios based on normal distribution and the empirical distribution

* How to construct a portfolio using PortfolioCVaR object

* How to evaluate the efficient frontier

* How to extract the portfolio weights

* How to calculate CVaR of the portfolio

Cite As

MathWorks Quant Team (2022).CVaR Portfolio Optimization(//www.tianjin-qmedu.com/matlabcentral/fileexchange/38288-cvar-portfolio-optimization), MATLAB Central File Exchange. Retrieved.

MATLAB Release Compatibility

Platform Compatibility

Windows macOS LinuxCategories

Tags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.