埃加奇

EGARCH conditional variance time series model

Description

Use埃加奇指定单变量egarch(指数概括自回归有条件的异质机)模型。这埃加奇function returns an埃加奇对象指定功能形式埃加奇(P,Q) 模型并存储其参数值。

这key components of an埃加奇模型包括:

GARCH polynomial, which is composed of lagged, logged conditional variances. The degree is denoted byP。

Arch多项式,由滞后标准化创新的大小组成。

杠杆作用polynomial, which is composed of lagged standardized innovations.

Maximum of the ARCH and leverage polynomial degrees, denoted byQ。

Pis the maximum nonzero lag in the GARCH polynomial, andQ是拱门中的最大非零滞后,并利用多项式。其他模型组件包括创新平均模型偏移,条件差异模型常数和创新分布。

All coefficients are unknown (NaN值)和可估算的,除非您使用名称值对参数语法指定其值。要估计包含所有或部分未知参数值给定数据的模型,请使用估计。For completely specified models (models in which all parameter values are known), simulate or forecast responses usingsimulate或者预报, respectively.

Creation

Description

MDL= egarch埃加奇目的。

MDL= egarch(P,Q)MDL) with a GARCH polynomial with a degree ofP, 和ARCH and leverage polynomials each with a degree ofQ。All polynomials contain all consecutive lags from 1 through their degrees, and all coefficients areNaNvalues.

This shorthand syntax enables you to create a template in which you specify the polynomial degrees explicitly. The model template is suited for unrestricted parameter estimation, that is, estimation without any parameter equality constraints. However, after you create a model, you can alter property values using dot notation.

MDL= egarch(Name,Value)'Archlags',[1 4],'ARCH',{0.2 0.3}specifies the two ARCH coefficients inARCHat lags1和4。

This longhand syntax enables you to create more flexible models.

Input Arguments

这shorthand syntax provides an easy way for you to create model templates that are suitable for unrestricted parameter estimation.例如,要创建一个包含未知参数值的egarch(1,2)模型,请输入:

mdl = egarch(1,2);

P—GARCH polynomial degree

nonnegative integer

GARCH polynomial degree, specified as a nonnegative integer. In the GARCH polynomial and at timet, MATLAB®包括所有连续记录条件的瓦里安ce terms from lagt– 1 through lagt–P。

You can specify this argument using the埃加奇(P,Q)仅速记语法。

IfP> 0, then you must specifyQ作为一个积极的整数。

Example:埃加奇(1,1)

Data Types:double

Q—ARCH polynomial degree

nonnegative integer

Arch多项式程度,指定为非负整数。在拱门多项式和时间t,MATLAB包括标准化创新项的所有连续幅度(用于拱门多项式)和所有标准化的创新项(对于杠杆多项式)t– 1 through lagt–Q。

You can specify this argument using the埃加奇(P,Q)仅速记语法。

IfP> 0, then you must specifyQ作为一个积极的整数。

Example:埃加奇(1,1)

Data Types:double

Specify optional comma-separated pairs ofName,Valuearguments.Nameis the argument name and价值是相应的值。Namemust appear inside quotes. You can specify several name and value pair arguments in any order asName1,Value1,...,NameN,ValueN。

这longhand syntax enables you to create models in which some or all coefficients are known. During estimation,估计imposes equality constraints on any known parameters.

'Archlags',[1 4],'ARCH',{NaN NaN}specifies an EGARCH(0,4) model and unknown, but nonzero, ARCH coefficient matrices at lags1和4。

GARCHLags—GARCH polynomial lags

1:P(default) |numeric vector of unique positive integers

GARCH polynomial lags, specified as the comma-separated pair consisting of'GARCHLags'和a numeric vector of unique positive integers.

GARCHLags(is the lag corresponding to the coefficientj)garch {。这lengths ofj}GARCHLags和GARCHmust be equal.

Assuming all GARCH coefficients (specified by theGARCHproperty) are positive orNaNvalues,max(GARCHLags)determines the value of thePproperty.

Example:'GARCHLags',[1 4]

Data Types:double

ARCHLags—ARCH polynomial lags

1:Q(default) |numeric vector of unique positive integers

ARCH polynomial lags, specified as the comma-separated pair consisting of'Archlags'和a numeric vector of unique positive integers.

ARCHLags(is the lag corresponding to the coefficientj)ARCH{。这lengths ofj}ARCHLags和ARCHmust be equal.

Assuming all ARCH and leverage coefficients (specified by theARCH和杠杆作用特性) are positive orNaNvalues,max([ARCHLags LeverageLags])determines the value of theQproperty.

Example:'Archlags',[1 4]

Data Types:double

杠杆作用Lags—杠杆作用polynomial lags

1:Q(default) |numeric vector of unique positive integers

杠杆作用polynomial lags, specified as the comma-separated pair consisting of'LeverageLags'和a numeric vector of unique positive integers.

杠杆作用Lags(is the lag corresponding to the coefficientj)杠杆作用{。这lengths ofj}杠杆作用Lags和杠杆作用must be equal.

Assuming all ARCH and leverage coefficients (specified by theARCH和杠杆作用特性) are positive orNaNvalues,max([ARCHLags LeverageLags])determines the value of theQproperty.

Example:'LeverageLags',1:4

Data Types:double

Properties

You can set writable property values when you create the model object by using name-value pair argument syntax, or after you create the model object by using dot notation.例如,创建具有未知系数的Egarch(1,1)模型,然后指定一个tinnovation distribution with unknown degrees of freedom, enter:

MDL= egarch('GARCHLags',1,'ARCHLags',1); Mdl.Distribution = "t";

P—GARCH polynomial degree

nonnegative integer

This property is read-only.

GARCH polynomial degree, specified as a nonnegative integer.Pis the maximum lag in the GARCH polynomial with a coefficient that is positive orNaN。Lags that are less thanP可以具有等于0的系数。

Pspecifies the minimum number of presample conditional variances required to initialize the model.

If you use name-value pair arguments to create the model, then MATLAB implements one of these alternatives (assuming the coefficient of the largest lag is positive orNaN):

如果指定

GARCHLags, thenPis the largest specified lag.如果指定

GARCH, thenPis the number of elements of the specified value. If you also specifyGARCHLags, then埃加奇usesGARCHLags确定Pinstead.除此以外,

Pis0。

Data Types:double

Q—Maximum degree of ARCH and leverage polynomials

nonnegative integer

This property is read-only.

Maximum degree of ARCH and leverage polynomials, specified as a nonnegative integer.Qis the maximum lag in the ARCH and leverage polynomials in the model. In either type of polynomial, lags that are less thanQ可以具有等于0的系数。

Q指定启动模型所需的最小预先样本创新数量。

如果您使用名称值对参数来创建模型,则MATLAB实现了这些替代方案之一(假设拱门中最大滞后的系数,并且利用多项式为正或NaN):

如果指定

ARCHLags或者杠杆作用Lags, thenQ是两个规格之间的最大值。如果指定

ARCH或者杠杆作用, thenQ是两个规格之间的最大元素数。如果您还指定ARCHLags或者杠杆作用Lags, then埃加奇uses their values to determineQinstead.除此以外,

Qis0。

Data Types:double

持续的—Conditional variance model constant

NaN(default) |numeric scalar

条件方差模型常数,指定为a numeric scalar orNaN价值。

Data Types:double

GARCH—GARCH polynomial coefficients

cell vector of positive scalars orNaNvalues

GARCH polynomial coefficients, specified as a cell vector of positive scalars orNaNvalues.

如果指定

GARCHLags, then the following conditions apply.这lengths of

GARCH和GARCHLags是equal.garch {is the coefficient of lagj}GARCHLags(。j)By default,

GARCHis anumel(GARCHLags)-by-1 cell vector ofNaNvalues.

除此以外,the following conditions apply.

这length of

GARCHisP。garch {is the coefficient of lagj}j。By default,

GARCHis aP-by-1 cell vector ofNaNvalues.

这coefficients inGARCHcorrespond to coefficients in an underlyingLagOplag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to1E–12或者below,埃加奇excludes that coefficient and its corresponding lag inGARCHLagsfrom the model.

Data Types:cell

ARCH—拱多项式系数

cell vector of positive scalars orNaNvalues

拱多项式系数, specified as a cell vector of positive scalars orNaNvalues.

如果指定

ARCHLags, then the following conditions apply.这lengths of

ARCH和ARCHLags是equal.ARCH{is the coefficient of lagj}ARCHLags(。j)By default,

ARCHis aQ-by-1 cell vector ofNaNvalues. For more details, see theQproperty.

除此以外,the following conditions apply.

这length of

ARCHisQ。ARCH{is the coefficient of lagj}j。By default,

ARCHis aQ-by-1 cell vector ofNaNvalues.

这coefficients inARCHcorrespond to coefficients in an underlyingLagOplag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to1E–12或者below,埃加奇excludes that coefficient and its corresponding lag inARCHLagsfrom the model.

Data Types:cell

杠杆作用—杠杆作用polynomial coefficients

cell vector of numeric scalars orNaNvalues

杠杆作用polynomial coefficients, specified as a cell vector of numeric scalars orNaNvalues.

如果指定

杠杆作用Lags, then the following conditions apply.这lengths of

杠杆作用和杠杆作用Lags是equal.杠杆作用{is the coefficient of lagj}杠杆作用Lags(。j)By default,

杠杆作用is aQ-by-1 cell vector ofNaNvalues. For more details, see theQproperty.

除此以外,the following conditions apply.

这length of

杠杆作用isQ。杠杆作用{is the coefficient of lagj}j。By default,

杠杆作用is aQ-by-1 cell vector ofNaNvalues.

这coefficients in杠杆作用correspond to coefficients in an underlyingLagOplag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to1E–12或者below,埃加奇excludes that coefficient and its corresponding lag in杠杆作用Lagsfrom the model.

Data Types:cell

无条件变异—Model unconditional variance

positive scalar

This property is read-only.

该模型无条件差异,指定为正标量。

这unconditional variance is

κis the conditional variance model constant (持续的).

Data Types:double

Offset—Innovation mean model offset

0(default) |numeric scalar|NaN

Innovation mean model offset, or additive constant, specified as a numeric scalar orNaN价值。

Data Types:double

Distribution—Conditional probability distribution of innovation process

"Gaussian"(default) |“ T”|structure array

Conditional probability distribution of the innovation process, specified as a string or structure array.埃加奇将值存储为结构数组。

| Distribution | String | Structure Array |

|---|---|---|

| Gaussian | "Gaussian" |

struct('名称',“高斯”) |

| Student’st | “ T” |

struct('名称',“ t”,'dof',dof) |

这'DoF'field specifies thet分配自由度参数。

DoF> 2 orDoF=NaN。DoFis estimable.如果指定

“ T”,DoFisNaNby default. You can change its value by using dot notation after you create the model. For example,MDL。Distribution.DoF = 3。如果您提供结构数组来指定学生的tdistribution, then you must specify both the

'Name'和'DoF'fields.

Example:struct('Name',"t",'DoF',10)

Description—Model description

字符串标量|character vector

模型描述,指定为字符串标量或字符向量。埃加奇stores the value as a string scalar. The default value describes the parametric form of the model, for example"EGARCH(1,1) Conditional Variance Model (Gaussian Distribution)"。

Data Types:string|char

Note

All

NaN- 值模型参数,其中包括系数和t-innovation-distribution degrees of freedom (if present), are estimable. When you pass the resulting埃加奇对象和数据估计, MATLAB estimates allNaN-valued parameters. During estimation,估计treats known parameters as equality constraints, that is,估计holds any known parameters fixed at their values.Typically, the lags in the ARCH and leverage polynomials are the same, but their equality is not a requirement. Differing polynomials occur when:

Either

Arch {Q}或者杠杆作用{Q}meets the near-zero exclusion tolerance. In this case, MATLAB excludes the corresponding lag from the polynomial.You specify polynomials of differing lengths by specifying

ARCHLags或者杠杆作用Lags, or by setting theARCH或者杠杆作用property.

In either case,

Qis the maximum lag between the two polynomials.

Object Functions

估计 |

Fit conditional variance model to data |

filter |

Filter disturbances through conditional variance model |

预报 |

预测条件方差模型的条件差异 |

推断 |

Infer conditional variances of conditional variance models |

simulate |

Monte Carlo simulation of conditional variance models |

summarize |

Display estimation results of conditional variance model |

Examples

Create Default EGARCH Model

Create a default埃加奇model object and specify its parameter values using dot notation.

Create an EGARCH(0,0) model.

MDL= egarch

MDL= egarch with properties: Description: "EGARCH(0,0) Conditional Variance Model (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 0 Q: 0 Constant: NaN GARCH: {} ARCH: {} Leverage: {} Offset: 0

MDLis an埃加奇model. It contains an unknown constant, its offset is0, 和the innovation distribution is'Gaussian'。该模型没有GARCH,ARCH或利用多项式。

Specify two unknown ARCH and leverage coefficients for lags one and two using dot notation.

MDL。ARCH = {NaN NaN}; Mdl.Leverage = {NaN NaN}; Mdl

MDL= egarch with properties: Description: "EGARCH(0,2) Conditional Variance Model (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 0 Q: 2 Constant: NaN GARCH: {} ARCH: {NaN NaN} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

这Q,ARCH, 和杠杆作用特性update to2,{NaN NaN},{NaN NaN}, respectively. The two ARCH and leverage coefficients are associated with lags 1 and 2.

Create EGARCH Model Using Shorthand Syntax

Create an埃加奇model object using the shorthand notation埃加奇(P,Q), wherePis the degree of the GARCH polynomial andQis the degree of the ARCH and leverage polynomial.

创建Egarch(3,2)模型。

mdl = egarch(3,2)

MDL= egarch with properties: Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 3 Q: 2 Constant: NaN GARCH: {NaN NaN NaN} at lags [1 2 3] ARCH: {NaN NaN} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

MDLis an埃加奇模型对象。所有属性MDL, exceptP,Q, 和Distribution, 是NaNvalues. By default, the software:

Includes a conditional variance model constant

不包括条件平均模型偏移(即偏移为

0)在Garch多项式中包括所有滞后术语

PIncludes all lag terms in the ARCH and leverage polynomials up to lag

Q

MDLspecifies only the functional form of an EGARCH model. Because it contains unknown parameter values, you can passMDL和time-series data to估计to estimate the parameters.

Create EGARCH Model Using Longhand Syntax

Create an埃加奇model object using name-value pair arguments.

Specify an EGARCH(1,1) model. By default, the conditional mean model offset is zero. Specify that the offset isNaN。Include a leverage term.

MDL= egarch('GARCHLags',1,'Archlags',1,'LeverageLags',1,'抵消',Nan)

MDL= egarch with properties: Description: "EGARCH(1,1) Conditional Variance Model with Offset (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 1 Q: 1 Constant: NaN GARCH: {NaN} at lag [1] ARCH: {NaN} at lag [1] Leverage: {NaN} at lag [1] Offset: NaN

MDLis an埃加奇模型对象。这software sets all parameters toNaN, exceptP,Q, 和Distribution。

SinceMDLcontainsNaNvalues,MDLis appropriate for estimation only. PassMDL和time-series data to估计。

Create EGARCH Model with Known Coefficients

创建具有平均偏移量的Egarch(1,1)模型

在哪里

和 is an independent and identically distributed standard Gaussian process.

MDL= egarch('持续的',0.0001,'GARCH',0.75,。。。'ARCH',0.1,'抵消',0.5,'Leverage',{-0.3 0 0.01})

mdl =带有属性的egarch:描述:“ egarch(1,3)条件方差模型具有偏移(高斯分布)”分布:name =“ gaussian” p:1 q:3常数:0.0001 garch:{0.75}在lag [1]] Arch:{0.1}在滞后[1]杠杆:{-0.3 0.01} lags [1 3]偏移:0.5

埃加奇assigns default values to any properties you do not specify with name-value pair arguments. An alternative way to specify the leverage component is'Leverage',{-0.3 0.01},'LeverageLags',[1 3]。

Access EGARCH Model Properties

Access the properties of a created埃加奇使用点表示法模型对象。

Create an埃加奇模型对象。

mdl = egarch(3,2)

MDL= egarch with properties: Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 3 Q: 2 Constant: NaN GARCH: {NaN NaN NaN} at lags [1 2 3] ARCH: {NaN NaN} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

从模型中删除第二个GARCH术语。也就是说,指定第二滞后条件差异的GARCH系数是0。

MDL。garch {2} = 0

MDL= egarch with properties: Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)" Distribution: Name = "Gaussian" P: 3 Q: 2 Constant: NaN GARCH: {NaN NaN} at lags [1 3] ARCH: {NaN NaN} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

这GARCH polynomial has two unknown parameters corresponding to lags 1 and 3.

Display the distribution of the disturbances.

MDL。Distribution

ans =struct with fields:Name: "Gaussian"

这disturbances are Gaussian with mean 0 and variance 1.

Specify that the underlying disturbances have atdistribution with five degrees of freedom.

MDL。Distribution = struct('Name','t','DoF',5)

MDL= egarch with properties: Description: "EGARCH(3,2) Conditional Variance Model (t Distribution)" Distribution: Name = "t", DoF = 5 P: 3 Q: 2 Constant: NaN GARCH: {NaN NaN} at lags [1 3] ARCH: {NaN NaN} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

Specify that the ARCH coefficients are 0.2 for the first lag and 0.1 for the second lag.

MDL。ARCH = {0.2 0.1}

MDL= egarch with properties: Description: "EGARCH(3,2) Conditional Variance Model (t Distribution)" Distribution: Name = "t", DoF = 5 P: 3 Q: 2 Constant: NaN GARCH: {NaN NaN} at lags [1 3] ARCH: {0.2 0.1} at lags [1 2] Leverage: {NaN NaN} at lags [1 2] Offset: 0

To estimate the remaining parameters, you can passMDL和your data to estimate and use the specified parameters as equality constraints. Or, you can specify the rest of the parameter values, and then simulate or forecast conditional variances from the GARCH model by passing the fully specified model tosimulate或者预报, respectively.

Estimate EGARCH Model

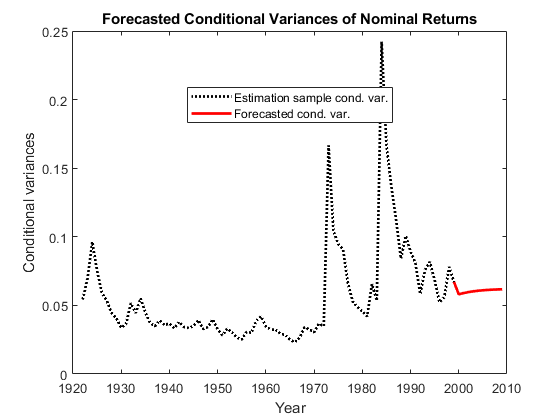

Fit an EGARCH model to an annual time series of Danish nominal stock returns from 1922-1999.

Load theData_Danishdata set. Plot the nominal returns (RN).

loadData_Danish;nr = DataTable.RN; figure; plot(dates,nr); hold在;plot([dates(1) dates(end)],[0 0],'r:');% Plot y = 0holdoff;标题(“丹麦名义股票返回”);ylabel('Nominal return (%)');xlabel(“年”);

这nominal return series seems to have a nonzero conditional mean offset and seems to exhibit volatility clustering. That is, the variability is smaller for earlier years than it is for later years. For this example, assume that an EGARCH(1,1) model is appropriate for this series.

Create an EGARCH(1,1) model. The conditional mean offset is zero by default. To estimate the offset, specify that it isNaN。Include a leverage lag.

MDL= egarch('GARCHLags',1,'Archlags',1,'LeverageLags',1,'抵消',Nan);

Fit the EGARCH(1,1) model to the data.

estmdl= estimate(Mdl,nr);

埃加奇(1,1) Conditional Variance Model with Offset (Gaussian Distribution): Value StandardError TStatistic PValue _________ _____________ __________ _________ Constant -0.62723 0.74401 -0.84304 0.3992 GARCH{1} 0.77419 0.23628 3.2766 0.0010508 ARCH{1} 0.38636 0.37361 1.0341 0.30107 Leverage{1} -0.002499 0.19222 -0.013001 0.98963 Offset 0.10325 0.037727 2.7368 0.0062047

estmdl是完全指定的埃加奇模型对象。也就是说,它不包含NaNvalues. You can assess the adequacy of the model by generating residuals using推断, 和then analyzing them.

To simulate conditional variances or responses, passestmdltosimulate。

To forecast innovations, passestmdlto预报。

Simulate EGARCH Model Observations and Conditional Variances

模拟完全指定的条件差异或响应路径埃加奇模型对象。That is, simulate from an estimated埃加奇model or a known埃加奇model in which you specify all parameter values.

Load theData_Danishdata set.

loadData_Danish;rn = DataTable.RN;

Create an EGARCH(1,1) model with an unknown conditional mean offset. Fit the model to the annual, nominal return series. Include a leverage term.

MDL= egarch('GARCHLags',1,'Archlags',1,'LeverageLags',1,'抵消',Nan);estmdl= estimate(Mdl,rn);

埃加奇(1,1) Conditional Variance Model with Offset (Gaussian Distribution): Value StandardError TStatistic PValue _________ _____________ __________ _________ Constant -0.62723 0.74401 -0.84304 0.3992 GARCH{1} 0.77419 0.23628 3.2766 0.0010508 ARCH{1} 0.38636 0.37361 1.0341 0.30107 Leverage{1} -0.002499 0.19222 -0.013001 0.98963 Offset 0.10325 0.037727 2.7368 0.0062047

模拟100路径的条件方差和再保险sponses from the estimated EGARCH model.

numObs = numel(rn);% Sample size (T)numPaths = 100;% Number of paths to simulaterng(1);% For reproducibility[VSim,YSim] = simulate(EstMdl,numObs,“数字”,numPaths);

VSim和YSIM是T-by-numPaths矩阵。行对应于样本周期,列对应于模拟路径。

Plot the average and the 97.5% and 2.5% percentiles of the simulate paths. Compare the simulation statistics to the original data.

VSimBar = mean(VSim,2); VSimCI = quantile(VSim,[0.025 0.975],2); YSimBar = mean(YSim,2); YSimCI = quantile(YSim,[0.025 0.975],2); figure; subplot(2,1,1); h1 = plot(dates,VSim,'Color',0.8*ones(1,3)); hold在;h2 = plot(dates,VSimBar,'k--','LineWidth',2);h3 =图(日期,vsimci,'r--','LineWidth',2);holdoff;标题('Simulated Conditional Variances');ylabel('Cond. var.');xlabel(“年”);subplot(2,1,2); h1 = plot(dates,YSim,'Color',0.8*ones(1,3)); hold在;h2 = plot(dates,YSimBar,'k--','LineWidth',2);h3 = plot(dates,YSimCI,'r--','LineWidth',2);holdoff;标题('Simulated Nominal Returns');ylabel('Nominal return (%)');xlabel(“年”);legend([h1(1) h2 h3(1)],{'Simulated path''Mean''Confidence bounds'},。。。'FontSize'7'地点','西北');

Forecast EGARCH Model Conditional Variances

Forecast conditional variances from a fully specified埃加奇模型对象。That is, forecast from an estimated埃加奇model or a known埃加奇model in which you specify all parameter values. The example follows fromEstimate EGARCH Model。

Load theData_Danishdata set.

loadData_Danish;nr = DataTable.RN;

Create an EGARCH(1,1) model with an unknown conditional mean offset and include a leverage term. Fit the model to the annual nominal return series.

MDL= egarch('GARCHLags',1,'Archlags',1,'LeverageLags',1,'抵消',Nan);estmdl= estimate(Mdl,nr);

埃加奇(1,1) Conditional Variance Model with Offset (Gaussian Distribution): Value StandardError TStatistic PValue __________ _____________ __________ _________ Constant -0.62723 0.74401 -0.84304 0.39921 GARCH{1} 0.77419 0.23628 3.2766 0.0010507 ARCH{1} 0.38636 0.37361 1.0341 0.30107 Leverage{1} -0.0024989 0.19222 -0.013 0.98963 Offset 0.10325 0.037727 2.7368 0.0062047

预测使用估计的Egarch模型将未来10年的名义返回序列的条件差异。将整个返回序列指定为前样品观测值。该软件使用预先样本观测和模型进一步进一步的条件差异。

numPeriods = 10; vF = forecast(EstMdl,numPeriods,nr);

Plot the forecasted conditional variances of the nominal returns. Compare the forecasts to the observed conditional variances.

v = infer(EstMdl,nr); figure; plot(dates,v,'k:','LineWidth',2);hold在;plot(dates(end):dates(end) + 10,[v(end);vF],'r','LineWidth',2);标题('Forecasted Conditional Variances of Nominal Returns');ylabel('Conditional variances');xlabel(“年”);legend({'Estimation sample cond. var.','Forecasted cond. var.'},。。。'地点','Best');

More About

EGARCH Model

AnEGARCH model是一个动态模型,可在创新过程中解决条件异方差或波动性聚类。当创新过程没有显示显着的自相关,而是过程随时间变化时,就会发生挥发性聚类。

An EGARCH model posits that the current conditional variance is the sum of these linear processes:

Past logged conditional variances (the GARCH component or polynomial)

Magnitudes of past standardized innovations (the ARCH component or polynomial)

Past standardized innovations (the leverage component or polynomial)

考虑时间序列

在哪里 这埃加奇(P,Q)条件差异过程, ,有形式

这table shows how the variables correspond to the properties of the埃加奇目的。

| Variable | Description | Property |

|---|---|---|

| μ | Innovation mean model constant offset | '抵消' |

| κ | Conditional variance model constant | '持续的' |

| γj | GARCH component coefficients | 'GARCH' |

| αj | 拱形组件系数 | 'ARCH' |

| ξj | 杠杆作用component coefficients | 'Leverage' |

| zt | Series of independent random variables with mean 0 and variance 1 | 'Distribution' |

Ifztis Gaussian, then

Ifztist与ν> 2 degrees of freedom, then

To ensure a stationary EGARCH model, all roots of the GARCH lag operator polynomial, , must lie outside of the unit circle.

这EGARCH model is unique from the GARCH and GJR models because it models the logarithm of the variance. By modeling the logarithm, positivity constraints on the model parameters are relaxed. However, forecasts of conditional variances from an EGARCH model are biased, because by Jensen’s inequality,

当正相同的正相冲击和负面冲击不同样促进波动时,Egarch模型是合适的[1]。

Tips

You can specify an

埃加奇model as part of a composition of conditional mean and variance models. For details, seearima。一个EGARCH(1,1)规范是足够复杂most applications. Typically in these models, the GARCH and ARCH coefficients are positive, and the leverage coefficients are negative. If you get these signs, then large unanticipated downward shocks increase the variance. If you get signs opposite to those signs that are expected, you can encounter difficulties inferring volatility sequences and forecasting. A negative ARCH coefficient is problematic. In this case, an EGARCH model might not be the best choice for your application.

References

[1] Tsay, R. S.Analysis of Financial Time Series。3rd ed. Hoboken, NJ: John Wiley & Sons, Inc., 2010.

See Also

Objects

Topics

- Specify EGARCH Models

- Modify Properties of Conditional Variance Models

- 指定条件均值和方差模型

- Infer Conditional Variances and Residuals

- Compare Conditional Variance Models Using Information Criteria

- Assess EGARCH Forecast Bias Using Simulations

- Forecast a Conditional Variance Model

- Conditional Variance Models

- EGARCH Model

Open Example

You have a modified version of this example. Do you want to open this example with your edits?

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:。

Selectweb siteYou can also select a web site from the following list:

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina(Español)

- Canada(English)

- United States(English)

欧洲

- Netherlands(English)

- 挪威(English)

- Österreich(德意志)

- Portugal(English)

- 瑞典(English)

- Switzerland

- United Kingdom(English)